is car loan interest tax deductible 2019

The deduction is based on the portion of mileage used for business. An individual taxpayer can claim interest on loan of an electric vehicle of up to INR 15 lacs us 80EEB.

2019 Automobile Deduction Limits In Canada Hogg Shain Scheck

If you were to claim the Section 179 deduction you could take a 15000 deduction 20000 075 on your 2021 tax return which youd file in early 2022.

. To deduct interest on passenger vehicle loans take the lesser amount of either. Credit card and installment interest incurred for personal expenses. You may be able to deduct the car sales tax you paid when you bought a new or used vehicle from a dealer or private seller.

Car loan interest is tax deductible if its a business vehicle. Car loan interest can add thousands of dollars to the price of a new car or truck. 10 x the number of days for which interest was payable.

If you use your car for business purposes you may be allowed to partially deduct car loan interest as a business expense. The 6000-pound vehicle tax deduction is a rule under the federal tax code that allows people to deduct up to 25000 of a vehicles purchasing price on their tax return. 1 Best answer.

The amount owed in car sales tax will be clear on the purchase order thatll state your TTL tax title and licensing fees. Heather can deduct 5728 as motor vehicle expenses for her 2021 fiscal period. Thus as the interest on car loan is allowed to be treated as an expense this reduces the income tax.

For vehicles purchased between December 31 1996 and January 1 2001 only. Points if youre a seller service charges credit investigation fees and interest relating to tax-exempt income such as. The deduction limit in 2021 is 1050000.

You use the car for business purposes 75 of the time. The standard mileage rate already factors in costs like gas taxes and insurance. If a taxpayer uses the car for both business and personal purposes the expenses must be split.

You can generally figure the amount of your. Business owners and self-employed individuals. After gathering up all of his receipts dave calculates that he spent 8000 on his car including gas and maintenance.

However if the electric vehicle is used for the purpose of business the vehicle should be reported as an asset loan should be reported as a liability and the interest on loan. The benefit Section 80EEB can be claimed by individuals only. For example the California car sales.

The personal portion of the interest will not be deductible. If a personal loan is being used for mixed purposes like a car loan with the car split between business and personal use then the portion of the interest thats deductible is proportional. Interest allowed as deduction us 80EEB will not be allowed as deduction under any other provision of the Act for the same or any other assessment.

Is Car Loan Interest Tax Deductible. Typically deducting car loan interest is not allowed. However if you use the car for both business and personal purposes you may deduct only the cost of its business use.

In contrast reporting the interest on a car loan can. In this case neither the business portion nor the personal portion of the interest will be deductible. Both states and local governments can charge sales tax.

Car loan interest is tax deductible if its a business vehicle You cannot deduct the actual car operating costs if you choose the standard mileage rate. Interest Payable subject to a maximum of Rs150000-. Experts agree that auto loan interest charges arent inherently deductible.

Find out if the interest you are paying on your car title loan is tax deductible. If you use your car for business purposes you may be able to deduct actual vehicle expenses. As the interest on car loan is allowed to be treated as an expense this reduces the taxable profit which in turn reduces the Income Tax to be paid.

Interest on loan to buy vehicle 2200. 1 Best answer. Lantern by SoFi seeks to provide content.

June 7 2019 301 PM Car loan interest would be deductible if the vehicle was used for self employment or in the service of an employer but it. Interest paid on a loan to purchase a car for personal use. 10 Interest on Car Loan 10 of Rs.

You cannot deduct the actual car operating costs if you choose the standard mileage rate. Your modified adjusted gross income is below 70000. 510 Business Use of Car.

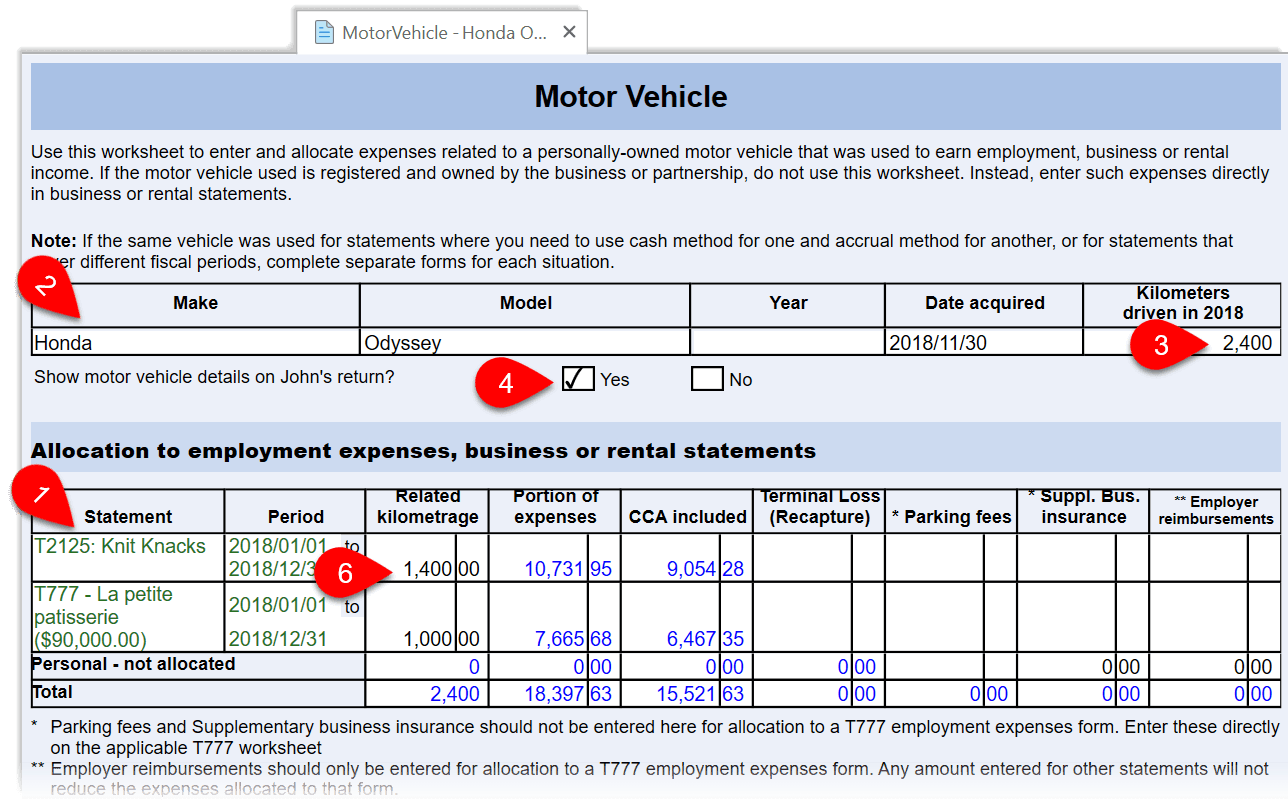

For example lets say you spent 20000 on a new car for your business in June 2021. Self-employed workers report motor vehicle expenses on the T2125 Statement of Business or Professional Activities form. June 7 2019 301 PM.

The vehicle purchased must weigh over 6000 pounds according to the gross vehicle weight rating GVWR but no more than 14000 pounds. But you will need to keep accurate. You cannot deduct a personal car loan or its interest.

Is Car Loan Interest Tax Deductible 2019. June 6 2019 1046 AM. Read more about our Editorial Guidelines and How We Make MoneyDeducting auto loan interest on your income-tax return is not typica.

If you use your car only for business purposes you may deduct its entire cost of ownership and operation subject to limits discussed later. Car loan interest is tax deductible if its a business vehicle. When repaying student loans interest is tax deductible provided that you do not file separately while being married.

If the vehicle is entirely for personal use. If you use your car for business purposes you may be allowed to partially deduct car loan interest as a business expense. While traditional loans may offer benefits such as tax-deductible interest.

You cant even deduct depreciation from your business car because thats. The standard mileage rate already factors in. If the vehicle is being used in part for business as an employee and the expenses are being deducted as an itemized deduction.

Individuals who own a business or are self-employed and use their vehicle for business may deduct car expenses on their tax return. This is why you need to list your vehicle as a business expense if you wish to deduct the interest youre paying on a car loan. Heather determines the motor vehicle expenses she can deduct in her 2021 fiscal period.

20000 business kilometres 25000 total kilometres 7160 5728. While typically deducting car loan interest is not allowed there is one exception to this rule. Car loan interest would be deductible if the vehicle was used for self employment or in the service of an employer but it is not deductible for personal use.

You cant even deduct depreciation from your business car because thats also factored in. But there is one exception to this rule. You cant get a tax deduction on interest from auto loans but mortgages and student loans do allow you to take a tax break under certain conditions.

In order to do this your vehicle needs to fit into one of these IRS categories. What is the Amount of deduction an Eligible Assesse can get under Section 80EEB.

Business Vehicle Tax Deductions For 2019 Owners Tips Autotrader Ca

What Happens To Ppf And Epf When You Become An Nri Mint

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Best Tax Return Softwares In Canada 2022 Greedyrates Ca

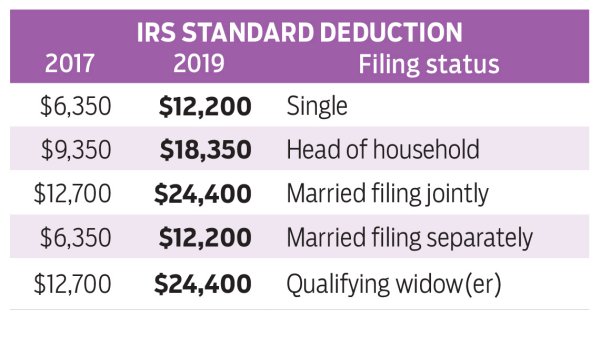

Understanding The New 2019 Federal Income Tax Brackets Slabs And Rates Tax Brackets Federal Income Tax Income Tax Brackets

The Top 9 Tax Deductions For Individuals In Canada

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Give To Charity But Don T Count On A Tax Deduction

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

Are Health Insurance Premiums Tax Deductible Tax Refund Tax Deductions Second Hand Furniture Stores

Know About The Vehicle Expenses Tax Deductions That Could Save You Money This Year

Wealthsimple Tax Review 2022 Formerly Simpletax Greedyrates Ca

![]()

What Is Line 10100 Or 101 On Your Tax Return Loans Canada

Motor Vehicle Expenses Taxcycle

Business Vehicle Tax Deductions For 2019 Owners Tips Autotrader Ca

What Are Miscellaneous Expenses Quickbooks Canada

Ten Ways To Reduce Taxes In 2019 The Globe And Mail

Tax Planning Tips For End Of 2018 Accuracy Plus Tax And Services

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)